The Future Social Security Crisis: How Can It Be Avoided? *

Genrich L. Krasko

As we all know, the situation with our Social Security system looks quite gloomy. Americans live longer and the number of elderly people will double in the next 30 years.

If nothing is done by our legislators, the Social Security program may collapse.

However, the shortfall is not going to be realized until 2041 or 2052, as estimated by the Social Security trustees and a nonpartisan Congressional Budget Office (CBO), respectively. If the system goes bankrupt, payroll tax revenue would only be enough to pay 75 percent of benefits. That is not encouraging at all!

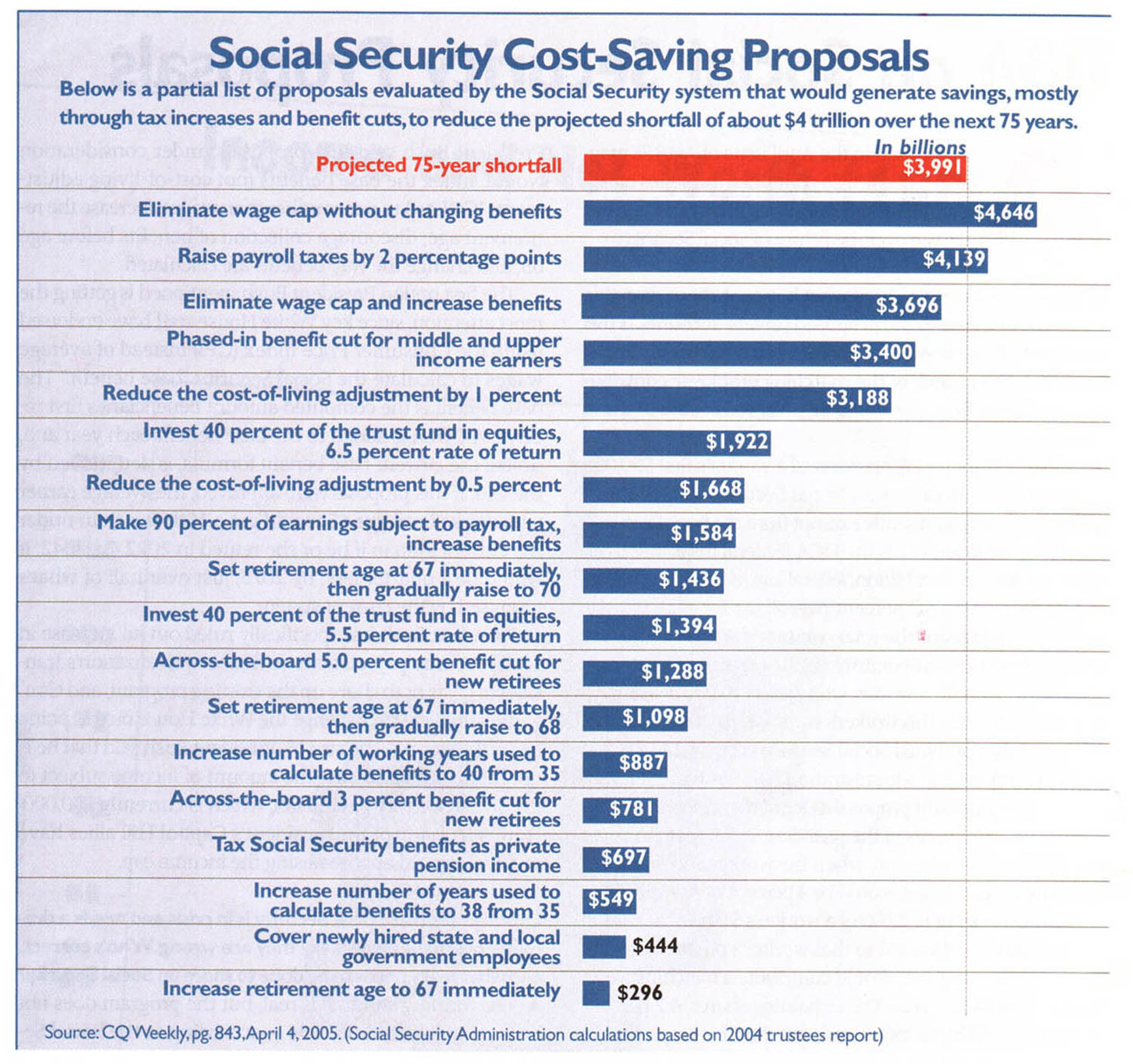

Various remedies may be considered, as shown in the chart below. They are compared against the projected 75-year shortfall: $3,991 B. Only two measures are able to prevent the shortfall.

One measure, raising payroll taxes across the board by 2 percent, will bring $4,139 B. The other one has to do with the Social Security tax, the so-called FICA (Federal Insurance Contribution Act).

All working Americans pay a Social Security tax, which is really two different taxes. A 1.42% tax is the so-called Medicare tax, it is withdrawn from the total taxable income. This pays for Medicare health insurance for retirees. Another tax – 6.2% (incremented by the same amount of money from the employer) – is supposed to create revenue from which future retirees will be receiving their Social Security checks. This tax applies not to a person’s total earnings but only to a part of it – up to a maximum of $97,500, as of this year (2007).

People in the top 20% income level contribute 50% of the total tax revenue. This is because the federal income tax is progressive: “The rich” pay 33% of most of their earnings, while the Social Security tax is flat. If the Social Security tax were flat but did not have a ceiling – that is, if it were taken from one’s total wages, rather than a part of it – that could be the best way to avoid the future Social Security crisis. Actually, eliminating the Social Security tax wage cap would contribute almost $4,646 billion! And yet, thus far, this option has not been widely discussed.

Of course, if this measure is implemented, it will mean a significant increase in taxes on high incomes, which is believed – at least by the present administration – to be detrimental to our economy. As we know, the tax cut for the wealthy has been motivated by the belief that it would improve the economy. However, nobody thus far has proved that the recent economic improvements were the result of this tax cut; besides, the extreme volatility of the stock market in 2007 is a sign of some unhealthy trends in our economy.

Nobody can predict how our Social Security crisis will be resolved. One may only hope that a new administration to come in 2008 will take some wise steps.

*Based on the data from June 2005 issue of NARFE (National Association of Retired Federal Employees) Bulletin, p. 14.