long-term care: The Looming Crisis

Genrich Krasko

Our society is getting older: increasingly more elderly people become recipients of social security benefits that puts our social security system in danger. Everybody is aware of it, and the problem is discussed constantly in Congress. However, there is another problem, perhaps more important for the elderly. It concerns a huge group of retirees, including those whose income is well above the minimum income guaranteed by our social security system. It is the problem of long-term health care, including the so-called "assisted living" and its ultimate form - nursing homes.

As we know, long-term health care in America is extremely expensive: Staying at a nursing home costs $100-300 per day ($35,000 - $109,000 per year)! With an average nursing home stay of three to five years, virtually nobody of the huge group of people needing nursing home services can pay for them, including those who all their lives have worked hard and managed to accumulate significant savings. The elderly of this category will have to surrender virtually all their assets in order to pay for their stay in a nursing home, before they become eligible for Medicaid. I have leafed through half a dozen books in which instructions are given of how to cheat the government, prevent it from seizing one's assets, and instead make it pay for one's nursing home from the Medicaid purse.

My family, as, I believe, thousands upon thousands of American families, has been recently targeted by insurance companies hunting for potential recipients of long-term health care. A variety of insurance policies has been developed. None of them would completely cover one's stay in a nursing home (or even be sold at all if one has pre-existing conditions undesirable to the insurers). All policies are prohibitively expensive; their documents are stuffed with fine print and details that only an experienced lawyer can understand.

The research undertaken by the Consumer's Union (Consumer Report, Oct., 1997) found that "Only about 10 to 20 percent of elderly can afford long-term-care insurance...A tax deduction that few are likely to use or benefit from is not a rational approach to the problem of long-term care. That leaves Medicaid...Medicaid pauperizes the families who must use it, and encourages the non-poor to shelter assets to qualify. Older Americans shouldn't have to become experts in techniques for divesting themselves of assets in order to plan for long-term care. Nor should they have to rely on welfare to pay for it. Rather than saddle the middle class with expensive insurance costs for policies that may be inadequate and unavailable to sick people, the public deserves a system like Medicare for long-term care." The conclusion of the Consumer Report experts: "The US still needs a universal system for all medical care - including long-term care - funded by a broad based tax and supported by a sense of shared responsibility for and obligation to the elderly."

Leaving aside the radical notion about the necessity of a universal health care system, I believe, nevertheless, that, a few extra tax dollars from each taxpayer - young and old - in fact would have solved the problem.

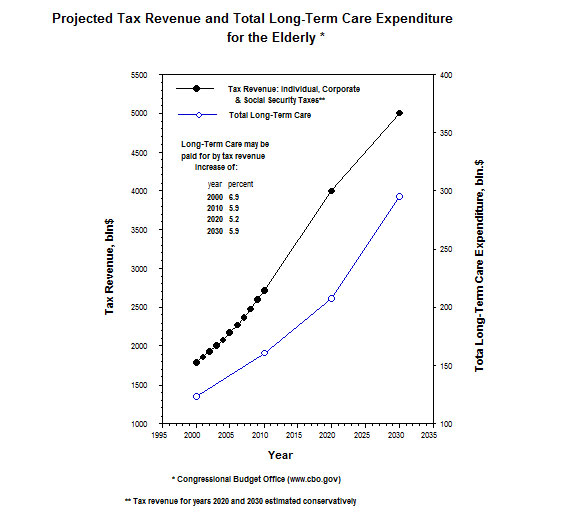

I recently came across interesting figures that support this point of view. The Congressional Budget Office has estimated both the projected federal tax revenue and the total long-term care expenditures for the years most crucial for our Social Security System: 2000-2030. These data have been plotted on the chart below.

Upon just a brief examination of the figures, one can see that in order for the long-term care to be completely paid from taxes, the tax revenue (not from a separate family, but from the whole nation) had to be increased by just 6.9% in the year 2000, and 5.9% in the year 2010. For example, in the year 2000, a family with two dependents and the adjusted gross income of $50,000 would have paid additional $500 in taxes to contribute to the complete support of not only their parents or grand-parents, but all American elderly needing long-term care.

This is an interesting response to Republican’s demagogical question: "Would you prefer to spend your money yourself, or let the government spend it for you?" This $500 would scarcely cover a two-three-month premium on a private insurance policy covering, at best, only half the long-term care costs. (I wonder why our less demagogical politicians never bring to light the "would you prefer" lie by slamming real numbers into the faces of those demagogues?)

Although the cost of long-term care in the years 2020 and 2030 will substantially increase, the federal tax revenue will increase even more steeply (if no drastic economy decline happens). Unfortunately, the Congressional Budget Office gives the projections of tax revenue only up to the year 2010. However, even the most conservative, and probably non-realistic, estimates of tax revenue for the years 2020 and 2030 (I deliberately "bent down" the plot of the tax revenue for those years) shows that the tax revenue increase by respectively 5.2% and 5.9% would completely cover the cost of nursing home and other assistance for all the retired baby-boomers. It is even possible that, with American economy booming, the necessary increase of the tax revenue will even be smaller – and this is in the most financially "dangerous" period: when all the baby-boomers will have retired.

When looking in the Internet through numerous articles on the problem of long-term health care, I have found out that the option of paying for long-term care from taxes was not even considered or mentioned. I understand that in today’s political climate, against the background of Republican demagoguery and anti-government and anti-tax populist rhetoric, the idea of the above-mentioned radical solution of long-term care seems unrealistic and impossible. However, when baby-boomers begin overpopulating nursing homes, the long-term health care will become the highest priority and radical measures will be necessary..

The signs of a serious crisis are already visible today. As a result of the sky-rocketing nursing home cost, increasingly more for profit nursing homes go out of business and get closed – simply because Americans are unable to pay for their services. Unfortunately, I do not have the statistic handy, but the problem is getting serious. If we do not do anything now it may result in a major turmoil when the time comes.

That is why it is so important to begin serious discussions of this problem today.

A related link:

Marcia Angell. The Forgotten Domestic Crisis

http://www.pnhp.org/news/2002/october/the_forgotten_domest.php